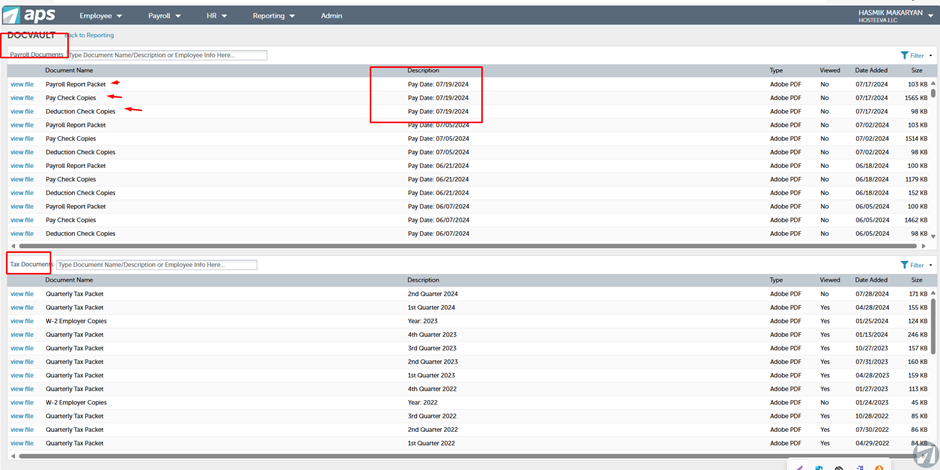

We use DocVault to pull out payroll reports for each payroll period and quarterly tax packets.

Please see the screenshot below.

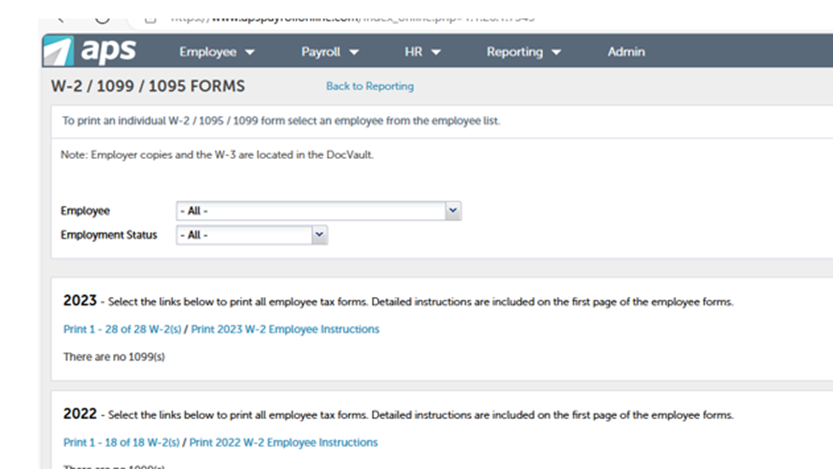

In the section W2 */ 1099/ 1095 forms we can find the copies of W-2 forms which we send to our employees at the end of the year. I will describe the full process by the end of the year to show the details,

* Form W-2, also known as the Wage and Tax Statement, is a document an employer sends to each employee and the Internal Revenue Service (IRS) and shows income earned from an employer and the amount of taxes withheld from an employee's pay check so taxpayers can file federal and state taxes. A W-2 employee is someone whose employer deducts taxes from their pay checks and submits this information to the government.

- Employers use W-2s to report FICA taxes for employees.

- The IRS uses W-2 forms to track individuals' tax obligations.