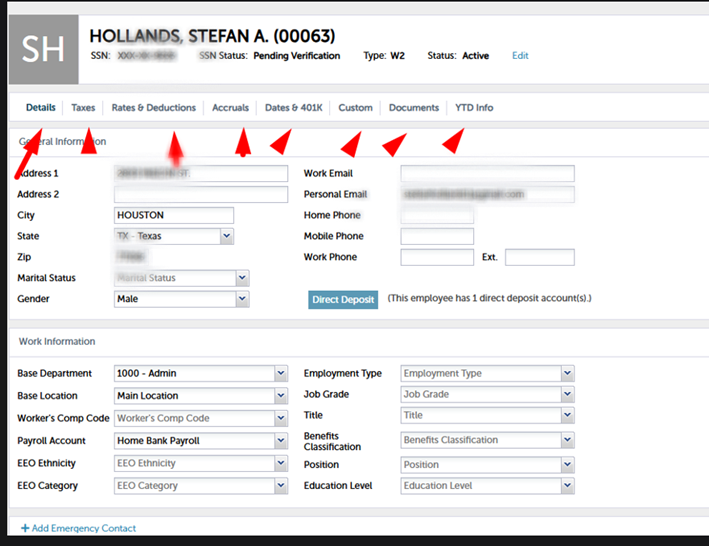

While viewing the employee's information, you can still make corrections. In the 'Detail' section, you can update the address, email address, and phone number, bank details for the direct deposit.

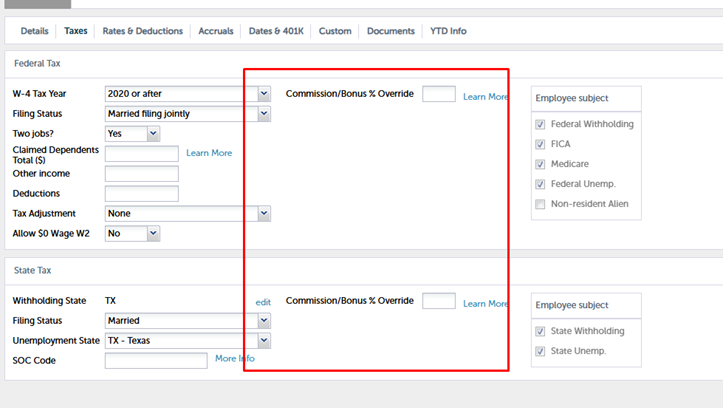

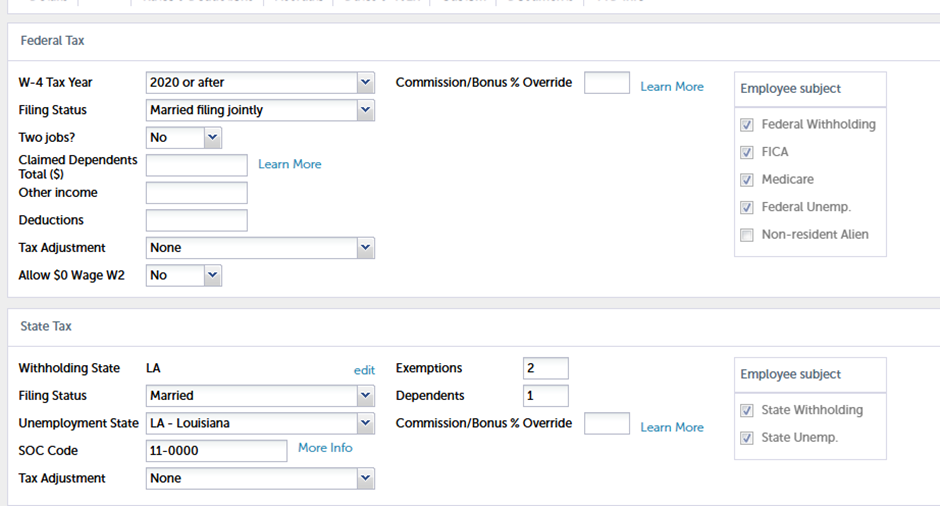

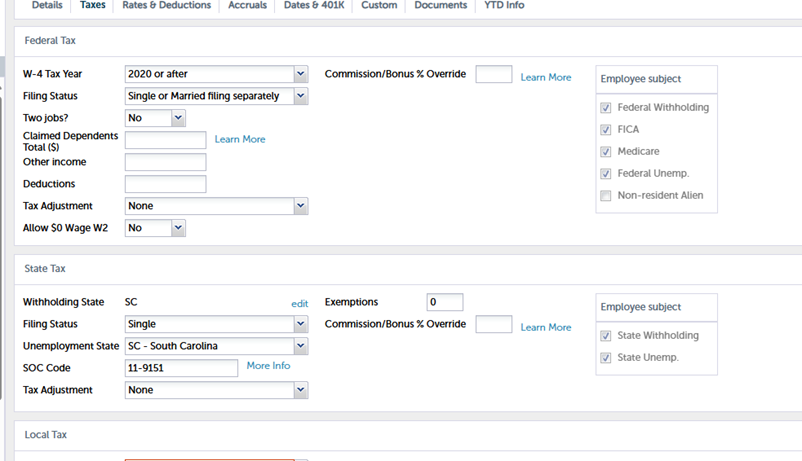

In the 'Taxes' section, you can adjust the filing status, number of dependents, and exemptions

For changes in the Taxes section, we should request an updated W-4 form from the employee.

Please note that requirements for federal tax and state tax information may vary from state to state,

Tennesse

Alabama

South Carolina

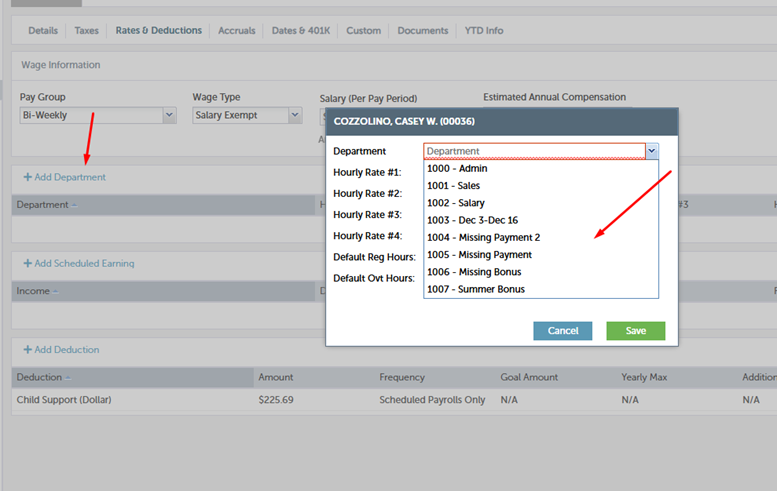

In the 'Rates and Deductions' section, you can adjust the salary or hourly rate and assign departments. For example, if we want to pay a bonus and specify the reason, we can create a separate department (such as 'Summer Bonus' or 'Holiday Bonus') and enter the amount under that category. Additionally, a second department can be added for handling missed bonuses, deductions, or payments.

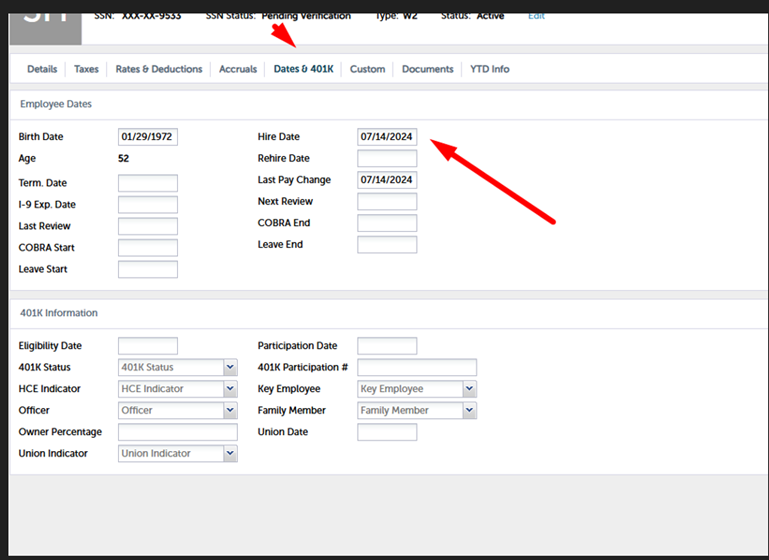

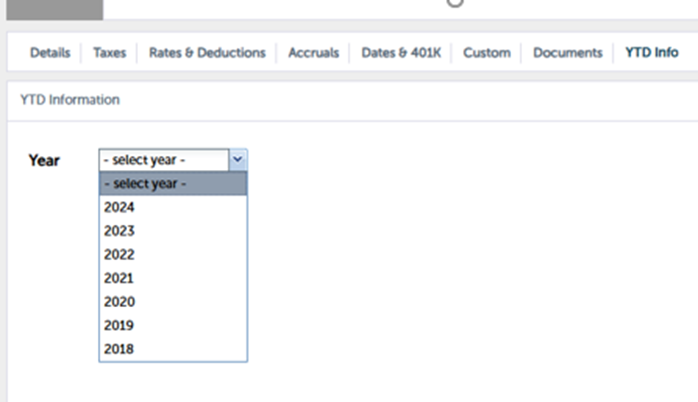

In the 'Dates' section, you can modify the hire date. The 'YTD Info' section allows you to view the years the employee has worked with us, along with the most recent pay dates and the total amounts for salary, taxes, and other details.